Week 36 Newsletter: Bitcoin

TL;DR

BTC is up

Bitcoin dominance is down

Dan Tapiero: Bitcoin's Path to $100K Unaffected by Election

Mt. Gox Delays Repayment to 2025

Supreme Court Clears Silk Road Bitcoin Sale

South Korean SEC Advances Bitcoin ETF Discussions

Peter Todd Refutes Satoshi Claims Amidst HBO Controversy

Bahrain Launches First Bitcoin Fund in GCC

IREN Faces Investor Lawsuit Over Misleading Claims

Mixed Performance Among Bitcoin Miners in September

Ethiopia Expands Bitcoin Mining Power to 600 MW

Bitcoin Price

Crypto is up this week, with BTC being up 0.9% and ETH up 0.7%:

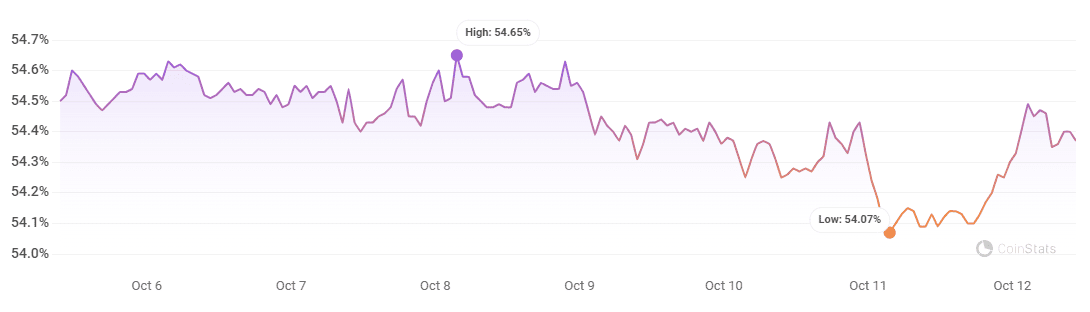

Bitcoin dominance has decreased over the week, starting from 54.5% to a peak of 54.7% and ending at 54.4%. Investor sentiment, regulatory changes, technological advancements, and the overall growth of the cryptocurrency sector shape Bitcoin's market dominance. Its reputation as "digital gold" also enhances its position, making it a key player in the market.

It’s going to be interesting to see whether this trend will continue in the short term, as capital in crypto tends to flow initially to BTC and then further out on the risk-curve, starting with altcoins like ETH and then into mid- or low-cap coins.

Bitcoin showed resilience following the release of the latest U.S. Producer Price Index (PPI) report, which revealed higher-than-expected inflationary pressures.

The PPI for September increased by 1.8%, surpassing the forecasted 1.6%, adding to concerns about rising inflation alongside the Consumer Price Index (CPI). Despite this, Bitcoin rebounded from a dip below $59,000, recovering by 4% and reaching as high as $61,500.

The Federal Reserve's recent 0.5% interest rate cut, criticized for being unnecessary by some market commentators, added complexity to the inflation outlook.

Traders remain divided on the Fed’s next move, with an 84% chance of a smaller 0.25% rate cut in November, according to CME Group’s FedWatch Tool.

Despite the inflation curveball, Bitcoin avoided further decline, holding the $60,600 support level, as analysts predict potential upward movements.

Some traders see the possibility of retesting the $62,000 and $65,000 resistance levels in the near term, while others warn that a breakdown below $60,200 could lead to another volatile dip before a potential recovery.

Overall, the market’s reaction indicates growing divergence between crypto assets and traditional stocks as inflation continues to weigh on the broader financial environment.

Bitcoin (BTCUSD) Analysis:

Bitcoin closed at $60,577 on October 11, 2024, showing a 17.09% drop from its yearly high. Short-term and medium-term analyses are negative, with key support at $53,769 and resistance at $66,845. Strong negative momentum and low RSI suggest further declines, though oversold conditions may trigger a rebound. Long-term trends remain neutral, with resistance at $70,000, indicating a hold recommendation for the long term.

Expected Trading Ranges: resistance level at $66,845 and support at $53,769.

Market Outlook

The market outlook for Bitcoin is cautious, with recent weakness below key support levels suggesting potential for further decline. Resistance at $66,845 may hinder upward movement, while oversold conditions could trigger a rebound. Long-term trends remain neutral, with critical resistance at $70,000. Investors should watch key levels for direction.

BTC/ETH ratio has seen an increase:

Over the past six days, the BTC to ETH conversion rate has experienced a net increase. Starting at 25.75 ETH on October 6, the rate dipped to a low of 25.32 ETH on October 10 before rising to 25.66 ETH on October 12. This represents an overall gain of 0.09 ETH during the period, indicating a positive trend despite some fluctuations in the rate.

DID YOU KNOW?

You can up your crypto game and gain an upper hand RIGHT NOW by grabbing a 7-day FREE trial to Coin Club!

What do you get access to when subscribing?