Unraveling the Ethereum Activation Queue: From Rise to Fall!

Embracing the Future of Ethereum Staking: A Journey from Waiting to Thriving!

In the realm of cryptocurrency, Ethereum staking has ignited unparalleled growth and captured immense interest.With its tremendous potential for earning passive income, more and more users are eager to activate their ETH validators and become part of the thriving blockchain ecosystem. However, this popularity surge has given rise to a significant challenge: the Ethereum Activation Queue.

In this article, we'll delve into the fascinating journey of the Ethereum Activation Queue, exploring the reasons behind its existence, how it operates, and most importantly, the promising projections that indicate its eventual vanishing act. Let's dive right in!

The Current Activation Queue Status:

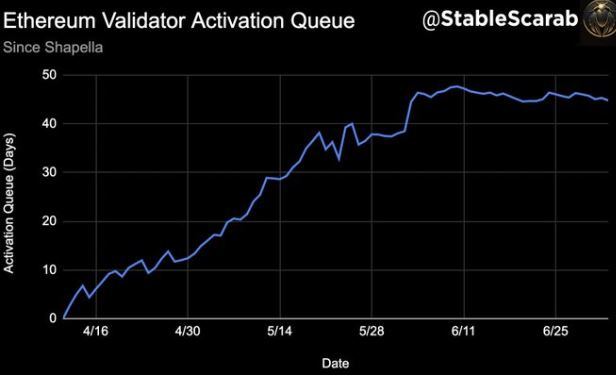

Aspiring validators seeking to join the Ethereum network are currently facing a long 44-day wait! The activation queue has soared due to the mounting interest in ETH staking post-Shapella. It's a mind-boggling situation, but there's hope on the horizon as the queue's upward trend begins to flatten out.

The Activation Queue:

To understand the activation queue, we need to familiarize ourselves with the Ethereum Node and its validation process. The purpose of the entrance/exit queue limits is to maintain finality between chains by preventing rapid changes in the validator set. This ensures the stability and security of the blockchain.

Its Work Mechanism:

The churn limit plays a vital role in controlling the number of validators entering each epoch. Presently, with a massive 647,930 validators, the current churn limit is set at 9, nearing to be 10. This translates to the addition of approximately 2025 validators on a daily basis.

The Insights of Daily Staked ETH:

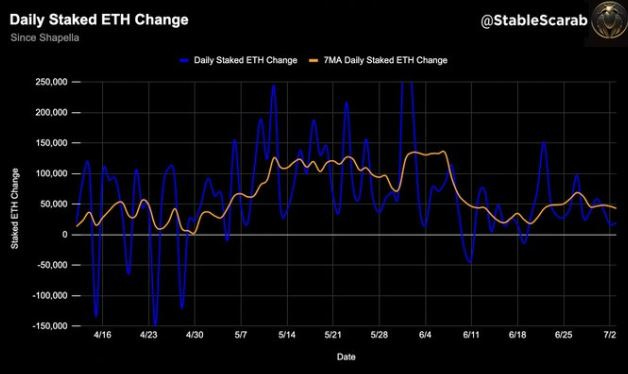

An intriguing revelation emerges as shown in the underlying analysis of staked ETH rate. Early June witnessed a noteworthy drop in ETH staking. The moving average of 7-day for ETH staked is recorded at 45k ETH/day. In contrast, the churn adds 2250 validators/day or a staggering 72,000 ETH/day, which surpasses the rate of staking.

Highlighting the Projections of the Activation Queue:

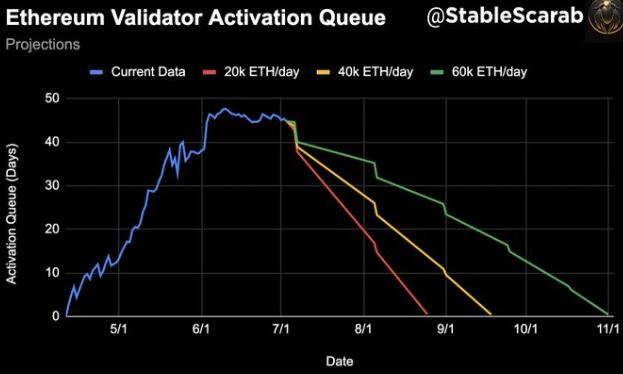

With various staked ETH rates taken into account, it is forecasted that the queue will begin to resolve:

• At a rate of 20k ETH/day, the queue might clear as early as August 25.

• With 40k ETH/day, expect resolution by September 18.

• And, with 60k ETH/day, the queue may vanish by November 1.

What is the Effect on LSD APRs ?:

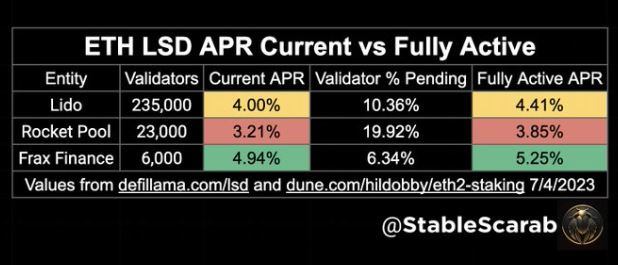

This prolonged queue has had a profound effect on different protocols. While @fraxfinance $sfrxETH maintains its lead with an impressive ~5% APR, @Rocket_Pool $rETH stands to gain the most, with around 20% of its validators currently pending. Even the incumbent @LidoFinance experiences a queue impact, with 10% of their validators awaiting activation.

Vanishing Queue Predictions:

Despite the significant ETH staking growth leading to the extended queue, there's a silver lining on the horizon. Decreasing staking rates and increasing churn paint an optimistic picture of the queue's eventual vanishing.

Conclusion:

The Ethereum Activation Queue has presented both challenges and opportunities for the blockchain community. As users eagerly anticipate activation, they can take solace in the projections that indicate a bright future, with the queue set to dissolve in the coming months. With a growing number of validators adding to the strength and security of the Ethereum network, the vanishing queue heralds an exciting era of growth and stability in the world of cryptocurrencies. Happy staking and see you on the other side of the queue!