Understanding Crypto - Deep Dive on Consensus Mechanisms

Demystifying Blockchain: How Consensus Mechanisms Keep Crypto Networks Secure

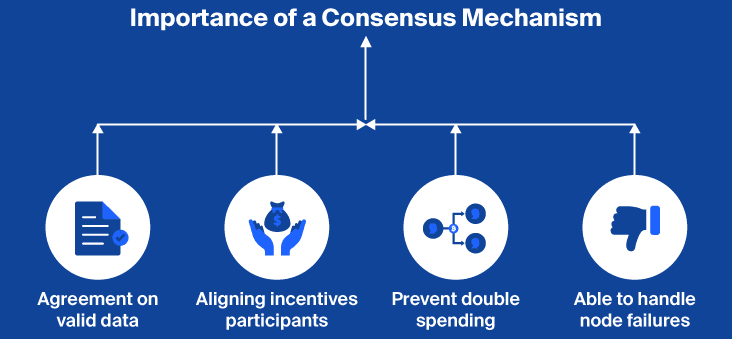

Consensus mechanisms are the backbone of the cryptocurrency world. They ensure that everyone in a decentralized network agrees on the same transaction history, a crucial function considering the absence of a central authority to manage the database. This article dives into the intricacies of consensus mechanisms, exploring their purpose, different models, and the role of miners and validators.

What is a consensus mechanism?

Imagine a group project where everyone needs to agree on a single version of the truth. In the realm of blockchains, achieving this consensus is paramount for maintaining trust and security. Consensus mechanisms act as the invisible hand, ensuring all participants in a distributed network agree on a single, verified record of transactions. This eliminates the need for a central authority like a bank to validate transactions and prevents issues like double-spending, where someone tries to spend the same digital currency twice.

There are two main goals for consensus mechanisms:

Validation: They verify transactions to prevent double-spending and ensure only legitimate activities are recorded on the blockchain.

Incentivization: They encourage network participants to follow the established rules. This fosters trust within a system where anonymity is a core principle.

Types of Consensus Mechanisms

The world of consensus mechanisms is vast and ever-evolving. However, two prominent models stand out: Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work (PoW): This is the granddaddy of consensus mechanisms, used by Bitcoin and other established cryptocurrencies. Miners compete to solve complex mathematical puzzles, and the winner gets to add the next block to the blockchain and earn rewards. The high computational power required discourages malicious actors, as attempting to disrupt the network would be expensive and unlikely to succeed.

Proof of Stake (PoS): This method takes a different approach. Instead of miners, validators lock up, or stake, a certain amount of the cryptocurrency as collateral. Validators are then chosen at random (with the size of their stake influencing the odds) to validate new transactions. Acting dishonestly comes at a steep price – validators risk losing their stake, a penalty known as slashing. This system incentivizes honest behavior as validators have a financial stake in maintaining the network's integrity.

Beyond PoW and PoS, there's a whole buffet of options, each with its own advantages and trade-offs. Delegated Proof of Stake (DPoS), Proof of Authority (PoA), and Proof of History (PoH) are just a few examples, each aiming to strike a balance between the holy trinity of blockchains: security, scalability, and decentralization. The choice of consensus mechanism significantly impacts how a cryptocurrency network functions. It influences its ability to resist attacks and process transactions efficiently.

The role of miners and validators

Miners and validators are the unsung heroes of the blockchain world. They play a critical role in upholding the security and reliability of these networks.

Miners (PoW): These individuals (or groups) compete in a constant race, solving cryptographic puzzles to secure the network. Every time a miner successfully adds a block, they validate the transactions within it and earn rewards in the form of cryptocurrency. This high computational effort discourages malicious activity, making it expensive and impractical to attempt to tamper with the network.

Validators (PoS): In Proof-of-Stake networks, validators take center stage. They stake a certain amount of cryptocurrency, essentially putting their skin in the game. Validators are then chosen to verify transactions, with the size of their stake influencing their selection chances. If they act dishonestly, they risk losing their staked funds, a powerful deterrent against malicious behavior.

Both miners and validators are incentivized through rewards for their efforts. These rewards compensate them for the resources they contribute – computational power in PoW and staked crypto in PoS. Whether it's mining or staking, these actors are essential for the smooth operation of decentralized networks, ensuring consensus is achieved and the ledger remains trustworthy.

Resolving consensus disputes

Blockchains operate in a world without a central authority. So, how do they resolve disagreements? This is where decentralized governance comes in. Consensus mechanisms are designed to handle situations where network participants, spread across the globe, might disagree on the validity of transactions or the current state of the ledger.

A classic example is double-spending, where someone tries to spend the same digital token twice. Consensus mechanisms are designed to detect and prevent such attempts. Additionally, they play a crucial role in handling proposed changes to the protocol's rules.

When disagreements arise, consensus mechanisms rely on a majority-rule system. This ensures decisions reflect the will of the broader network, not a select few. This decentralized governance model empowers the network to function with integrity and security, without relying on a traditional central authority.

Effectively resolving consensus disputes is vital for maintaining the stability and trustworthiness of blockchain networks.