TrueFi Introduces Dollar-Based TRI Token for Real-World Asset Trading

TrueFi's TRI Token: A Game Changer for Real-World Asset Trading in DeFi

Decentralized finance (DeFi) has opened a new frontier for financial products and services. One area with immense potential is the integration of real-world assets (RWA) on-chain. However, the market for on-chain RWA has seen a decline since its peak in April 2022.

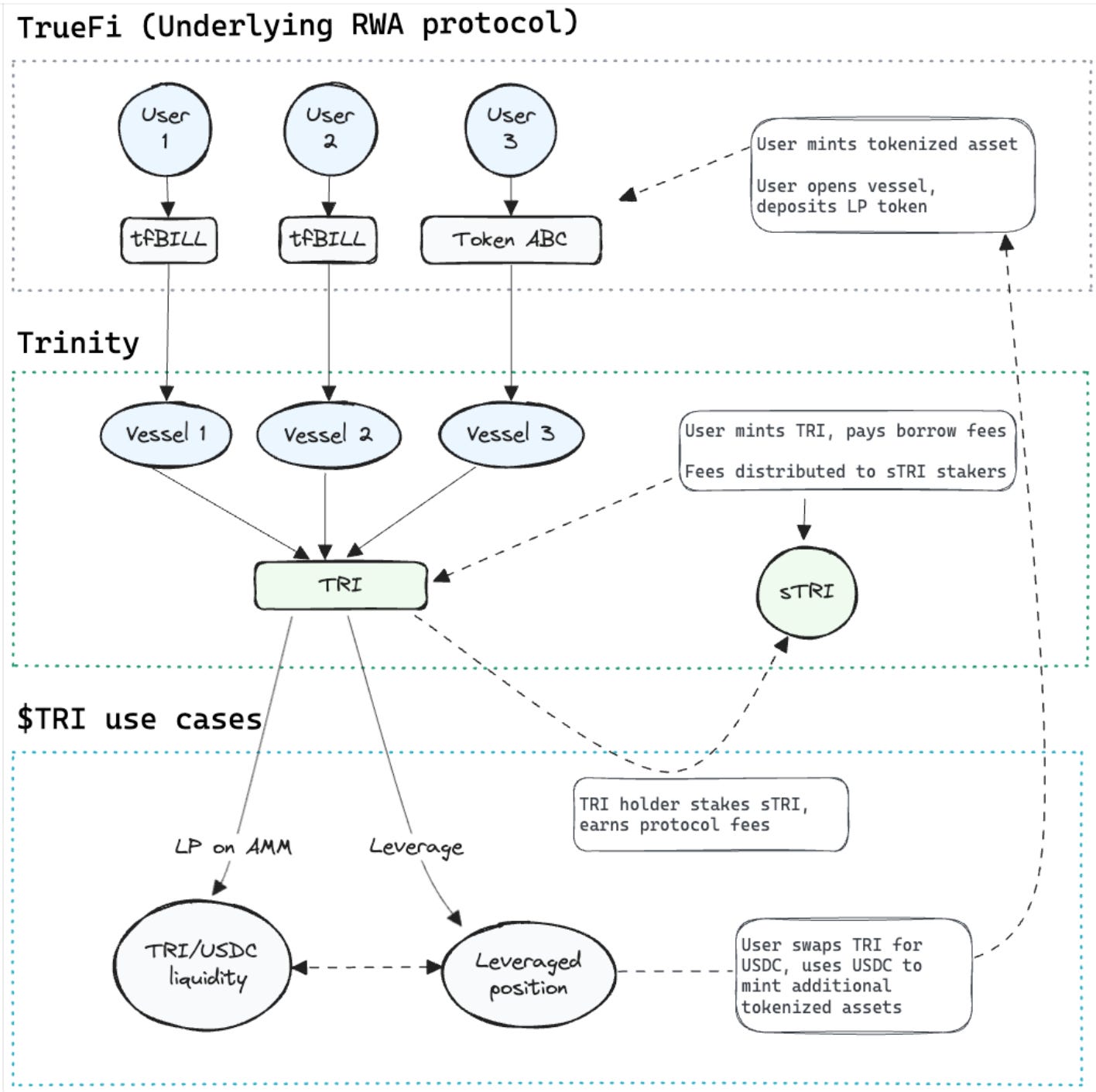

TrueFi, a prominent player in the DeFi credit space, is aiming to reignite this market with the introduction of the Trinity protocol. This innovative protocol leverages a dollar-based token, TRI, backed by collateral assets, to enhance capital efficiency for users engaging in real-world asset trading.

TRI: The Engine Powering Leverage and Risk Management

The core of Trinity lies in the TRI token. Designed as a dollar-based token, TRI is backed by collateral assets, providing stability and reducing volatility. This mechanism allows users to acquire leverage and hedge risks more effectively when trading real-world assets.

The first collateral asset used to back TRI will be the interest-bearing tfBILL, a tokenized version of short-term U.S. Treasury bills. This selection offers a safe and reliable source of backing for the TRI token. Notably, TrueFi doesn't limit itself to tfBILL. The protocol allows for the inclusion of other TrueFi pools, RWAs from various protocols, and even other crypto-native assets as potential collateral in the future.

Unlocking High Yields Through Strategic Use of TRI

The Trinity protocol offers users a versatile toolbox for maximizing returns. Here's a glimpse into how users can leverage TRI:

Minting TRI and Swapping for Liquidity: Users can mint TRI by depositing tfBILL or other approved collateral assets. This minted TRI can then be swapped for a stablecoin on an automated market maker (AMM) platform, providing immediate liquidity.

Leveraged Yield Farming: The protocol allows users to engage in a strategic process to amplify their yields. Here's how it works: a user mints TRI using collateral, then swaps it for a stablecoin. This stablecoin can then be used to mint even more TRI. By repeating this cycle, users can achieve a high loan-to-value ratio of up to 92%, potentially generating a net yield of 15-20%. It's important to remember that such leveraged strategies involve significant risk.

Alternative Strategies: Staking and Secondary Market Trading

While leveraged yield farming offers high potential returns, it's not the only way to benefit from TRI. Users who prefer a less risky approach can opt to swap their stablecoin holdings for TRI and stake them in the sTRI vault. This staking strategy allows users to earn a steady yield, projected to be near or even surpass T-bill rates.

Furthermore, TRI functions as a tradable token on secondary markets. This adds another layer of flexibility for users, enabling them to capitalize on price fluctuations and adjust their positions based on market conditions.

A Cautious Launch and the Road Ahead

TrueFi acknowledges the current subdued state of the on-chain RWA market, which sits at roughly a third of its peak in April 2022. To ensure a secure and controlled rollout, Trinity is currently live on the Optimism Sepolia testnet. After a thorough audit, TrueFi will select a group of initial users to participate in the launch.

The initial version of Trinity will have a capped mint supply of $40 million for TRI tokens. Notably, TrueFi plans to launch the protocol on Coinbase's layer-2 network, Base. Due to regulatory considerations, U.S. users will be excluded from the initial rollout. This "most conservative initial rollout," as TrueFi describes it, leverages Base's whitelist system to ensure only verified non-US users (around 150,000 addresses) and whitelisted institutions can participate.

TrueFi's foray into real-world asset trading with the TRI token and the Trinity protocol presents a promising prospect for the DeFi space. With its focus on capital efficiency, risk management, and user flexibility, Trinity has the potential to reignite the on-chain RWA market and unlock new avenues for DeFi users to engage with traditional financial instruments. As the protocol progresses through its testnet phase and towards its official launch, the industry will be watching with keen interest to see if it can deliver on its potential.