SWIFT and Blockchain? A Match Made in Heaven?

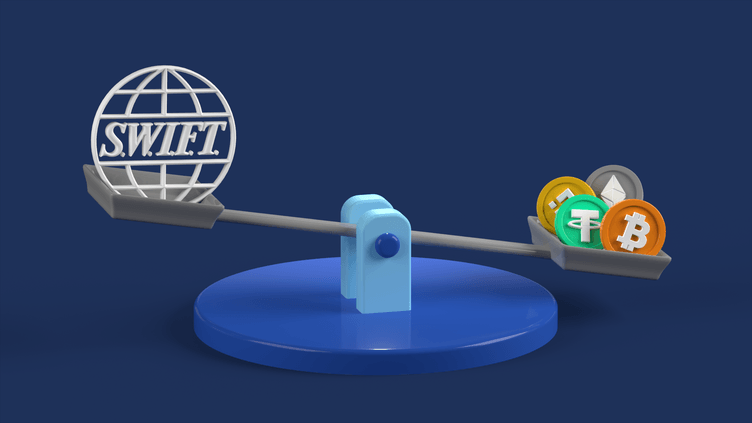

The Future of Payments: Can SWIFT and Blockchain Co-Exist?

The financial world is abuzz with the potential of blockchain technology to revolutionize cross-border payments. But what role does SWIFT, the current king of international transactions, see for itself in this brave new world? Surprisingly, SWIFT isn't waving the white flag. Instead, it's proposing a future where it plays a central role in a tokenized future on a unified ledger.

SWIFT Embraces the Future

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) has been a close observer of the fintech revolution, particularly as it pertains to its own long-term viability. After exploring various new technologies, SWIFT, the cornerstone of the current international payments system, has officially endorsed a unified ledger model for payments.

Their focus is on tokenization and the shared ledger system. In a blog post, SWIFT highlighted the potential of a common infrastructure that provides real-time balance visibility to all participants in the shared ledger. However, they were quick to point out that messaging remains crucial.

SWIFT acknowledges the limitations of shared ledgers: "Shared ledgers are not ideal for carrying and storing high volumes of data due to the data synchronization process across parties and the sheer computing power required. This is where a messaging layer becomes essential."

They add, "Frictionless transactions necessitate the transfer of additional data types to enable value-added services like AML (Anti-Money Laundering), compliance checks, sanctions screening, and trade and accounts receivable reconciliation."

Building on Existing Strengths

Instead of reinventing the wheel, SWIFT proposes the creation of a state machine – a dynamic model reflecting the current state of transactions and balances across institutions. This model could be built on top of the already widely used ISO-20022 messaging technology.

The beauty of this approach is its flexibility. The state machine could function on either a blockchain platform or a centralized platform like SWIFT's current Transaction Manager.

The unified ledger model boasts impressive backing. The International Monetary Fund has embraced it with its XC platform, and financial institutions within the Regulated Liability Network are actively participating. Furthermore, the Bank for International Settlements has also shown its support.

Shifting Strategies

SWIFT's current stance on unified ledgers marks a significant shift from its previous pronouncements. Founded in 1973, SWIFT initially explored other options before settling on this path. In 2022, they collaborated with fintech firm Symbiont in a pilot project to upgrade their information delivery system for corporate clients through Symbiont's blockchain-based Assembly platform.

However, a 2023 report by SWIFT advocated for its position as a "single point of access" to various blockchain networks, essentially arguing against a unified ledger system.

This shift in strategy suggests a recognition of the growing importance of blockchain technology in the financial landscape. SWIFT seems determined to remain a central player, even in a transformed ecosystem.

The Road Ahead

SWIFT's experience enforcing global economic sanctions underscores its significance in the financial world. In February 2022, following the Russian invasion of Ukraine, the European Commission ordered the removal of several Russian banks from the SWIFT network. This action highlighted SWIFT's power and reach.

Whether SWIFT's proposed state machine built on a unified ledger proves to be the future of international payments remains to be seen. However, their willingness to adapt and leverage new technologies suggests they're determined to stay relevant in the ever-evolving financial world.