Uniting Traditional Finance and DeFi: The REBUS Protocol

Bridging the Gap Between Traditional Finance and DeFi

REBUS has been making headlines recently, and it's time to delve into the protocol and the project behind it. With the ambitious goal of bringing Traditional Finance (TradFi) and Decentralized Finance (DeFi) together, RebusChain is on a mission to revolutionize the financial industry.

Mission

Rebus' primary mission is to create both generic and custom financial products tailored to the needs of traditional financial institutions such as banks, asset managers, and insurance companies, enabling them to offer crypto access to their customers. This mission seeks to bridge the gap between the traditional and crypto financial worlds.

Target Audience

Primary Targets include financial operators, including banks, private banks, custodians, intermediaries, asset managers, and insurance companies. Secondary Targets are considered the independent investors who prefer to invest without financial intermediaries.

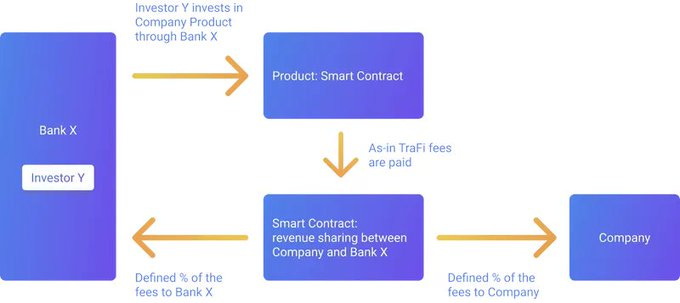

Business Model

Rebus serves as the intermediary between banks, single investors, and the companies they invest in, making it a vital bridge within the ecosystem. This ensures a seamless flow of revenue between these entities.

Products

Rebus has an ambitious product roadmap, aiming to offer a wide range of financial products and toolkits. Some of these products generate revenue for the protocol, while others aim to expand the network. Notable products and toolkits include Rebus Vault for secure deposits, Ribor offering Rebus Inter-Blockchain Offer Rates, liquidity products, staking products, stable coin products, and NFTs.

Process

The Rebus protocol streamlines the investment process. TradFi investors can place orders for DeFi investments on the Rebus platform. Funds are then sent to the Rebus Vault, which initiates smart contracts using Inter-Chain Accounts (ICA) and Inter-Blockchain Communication (IBC) within the Cosmos ecosystem. Once the contract is executed, the resulting funds are sent to the Rebus Investment Platform, simplifying the entire process.

Tokenomics

Rebus employs a well-thought-out token distribution strategy that you can explore on their website. Over time, the token distribution will gradually shift to enhance Rebus' treasury and promote wider public distribution.

Staking

One aspect that has piqued the interest of many is Rebus' staking rewards. The Proof of Stake (PoS) reward structure offers enticing annual returns. For those looking to compound their rewards, @yieldmos provides a way to convert $REBUS rewards from 587% APR to an impressive 33,742% APY through automated compounding.

In conclusion, Rebus is making bold moves to bridge the gap between traditional finance and DeFi, aiming to create a seamless and profitable ecosystem for financial institutions and individual investors. With a comprehensive product suite and attractive staking rewards, it's a project that's certainly worth keeping an eye on as it continues to evolve and shape the future of finance.