Perpetual (Perp) DEXs is poised for growth

Perp DEXs stand to benefit from the harsh regulatory environment, and is perfectly positioned for massive growth

Perp DEXs stand to benefit from the harsh regulatory environment, and is perfectly positioned for massive growth.

The upside is huge.

Did you know?

Perp DEX volume needs to grow by 99x to match the ratio of perp to spot volume on CEX.

The top 10 perp DEXs by 30d trading volume:

1. $37.2b - @dYdX

2. $4.9b - @GMX_IO

3. $4.2b - @Kwenta_io

4. $3.0b - @GainsNetwork_io

5. $2.6b - @Level__Finance

6. $1.7b - @muxprotocol

7. $1.4b - @vertex_protocol

8. $795m - @perpprotocol

9. $732m - @ApolloX_Finance

10. $331m - @CapDotFinance

Let's take a look at the top 3, how they operate and their tokenomics & value accrual.

1. $37.2b - @dYdX

2. $4.9b - @GMX_IO

3. $4.2b - @Kwenta_io

dYdX

As the 1st perp DEX to launch, dYdX offers leveraged trading (up to 20x) on 36 pairs.

dYdX utilizes an off-chain order book to provid deep liquidity at the expense of decentralization.

dYdX v4 will go live on its own Cosmos blockchain, aiming to make the protocol fully decentralized.

The new version will also introduce a highly requested feature: revenue sharing.

Stakers of $DYDX will be able to earn a % of the revenue generated by the platform.

$DYDX Tokenomics

Total Supply: 1,000,000,000

Investors: 27.7%

Trading Rewards: 20.2%

Employees & Consultants: 15.3%

Airdrop: 5%

LP Rewards: 7.5%

Future Employees: 7.0%

Treasury: 16.2%

Liquidity Staking Pool: 0.6%

Safety Staking Pool: 0.5%

GMX

GMX offers swap & margin trading with zero slippage as users trade against the GLP pool.

GLP = Basket $BTC $ETH $UNI $LINK and 4 stables

The advantage of this model is composability; several protocols started creating investing products that utilize GLP and its yields.

$GMX Tokenomics

Token Supply: 8,813,076

XVIX and Gambit Migration: 45.3%

Floor Price Fund: 15.1%

Reserve: 15.1%

Liquidity: 15.1%

Presale Round: 7.6%

Marketing & Partnerships: 1.9%

Kwenta

Kwenta is a decentralized derivatives trading platform offering perpetual futures and options trading on Optimism.

Currently, the platform offers 42+ pairs of crypto, forex, and commodities with leverage up to 50x.

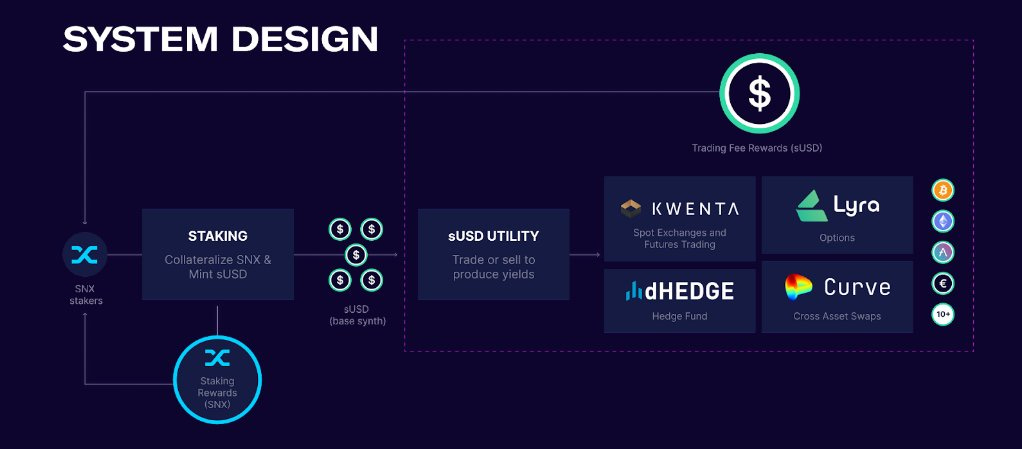

Kwenta has a partnership with @synthetix_io, which provides the underlying protocol for managing liquidity and offering perps directly.

This allows Kwenta to focus on user experience and interface design while Synthetix focuses on liquidity mechanisms.

$KWENTA Tokenomics

Total Supply: 1,000,000,000

Synthetix Stakers: 30.00%

Synthetix + Early Kwenta Traders: 5.00%

Investment: 5.00%

Community Growth Fund: 25.00%

Core Contributors: 15.00%

Kwenta Treasury: 20.0%