Nolus Protocol Strategies: Maximizing Yield on Cosmos

Nolus Protocol just published 5 strategies on how to generate more yield with their protocol. Do yourself + your wallet a favour and pay attention.

@NolusProtocol just published 5 strategies on how to generate more yield with their protocol. Do yourself + your wallet a favour and pay attention!

Strategy 1: Open a Leveraged Long Position

Borrow a specific asset you believe will rise in value. With a DeFi Lease, your profit potential increases, and using liquid staked derivatives as collateral can earn staking rewards.

Strategy 2: Deposit to the Liquidity Providers' Pool

Earn passive income by depositing $axlUSDC. Receive interest from borrowers and $NLS incentives, which can be staked for further rewards.

Strategy 3: Add Value to a Short Position

Combine shorting mechanisms with Nolus Protocol. Borrow $ATOM, sell for $axlUSDC, and profit if $ATOM price drops. Explore options to leverage or separate borrowings.

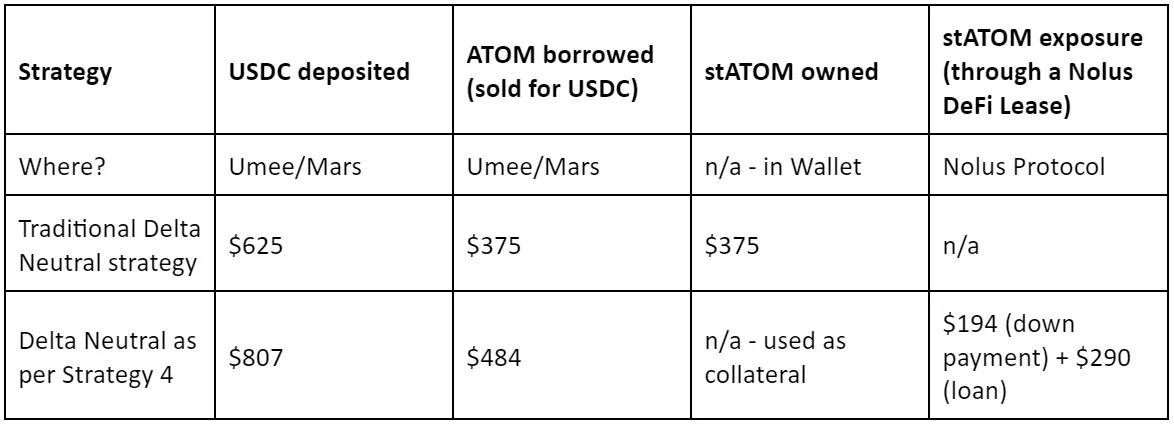

Strategy 4: The "Power Hedgooor"

Create a delta-neutral strategy by depositing $USDC, borrowing $ATOM, and selling it. Hold $stATOM in a DeFi Lease for additional price exposure. Manage LTV to avoid liquidation.

Strategy 5: The "Power Leveragooor"

Expand on Strategy 1 by depositing an asset in a money market, borrowing stablecoin, and buying more of the asset via a DeFi Lease. Increase exposure with higher LTVs.

Nolus offers something for everyone, from the risk-averse to the risk lover. Explore various strategies to maximize your asset's potential.

But remember to manage LTVs on both Nolus Protocol and traditional money markets to avoid liquidation risks and ensure safety.

Nolus Protocol continues to evolve, providing flexibility for a wide range of strategies. Stay tuned for more possibilities and opportunities.