Market Update Week 4 2024

The premium weekly crypto market update to grow your portfolio

TLDR: BTC & ETH is down. Bitcoin dominance is up. The hot coin we look at this week is WHALE.

Latest & Greatest 📰

Before we dive into both current and new airdrops, make sure to check the latest and greatest news and market update from Coin Club:

Make sure to follow Coin Club for continuous updates about all things Crypto, Blockchain and Web3.

BTC & ETH Market Update 📈

Crypto is down (again) this week, with BTC being down 0.5% and ETH down 9.6%:

Two weeks ago ETH saw a price surge of almost 15%, so it’s natural to see a little bit of a pullback. However, BTC and its decrease looks to be a general offloading of BTC due to the spot Bitcoin ETF.

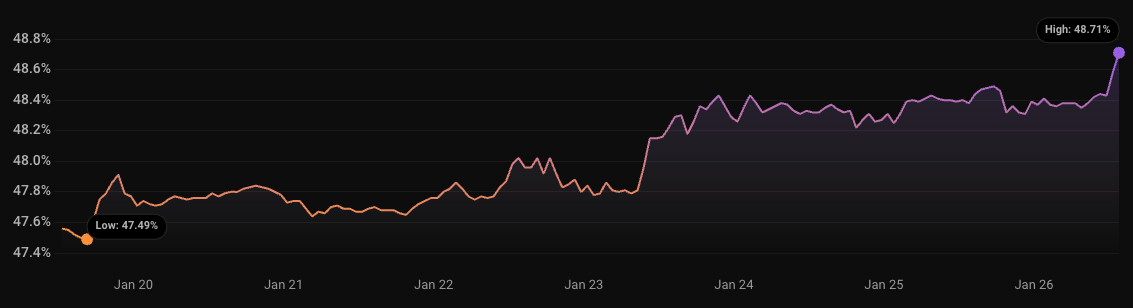

Bitcoin dominance has been somewhat stagnant this week, starting at 47.5% ending the week at 48.7%. It seems that capital initially this week flew to Bitcoin as the BTC spot ETF was getting approved, and then either moved back or continued over to altcoins like ETH, where capital usually flows to up until when Bitcoin dominance has peaked and starts to decrease, moving capital into more risky mid- or low-cap coins.

The Bitcoin halving is coming up end of March or beginning of April 2024. If history is any guidance we will continue to see BTC dominance climb up until after Bitcoin halving, whereafter people start to look for higher return moving further on the risk curve entering altcoins. This typically starts with ETH, and then on to mid- and low cap coins. Other coins being moved into are typically “ETH killers” like SOL, AVAX and other other L1s. Yet ETH is still the king amongst altcoins, as price action this week also shows.

With BTC dominance being stagnant, the BTC/ETH ratio is trending upwards to 18.3 ETH per BTC, underlining that BTC continues to be king in crypto, and that alts like ETH are not gaining momentum against BTC.

For general news and updates on Bitcoin and Ethereum, make sure to subscribe to Coin Club’s free weekly newsletter.

Hot Coin: WHALE 🔥

In this week’s newsletter we dive into Migaloo’s White Whale token with the ticker: $WHALE.

The price action and volume is starting to look juicy:

What is the project about?

White Whale looks to solve the problem of liquidity fragmentation.

Liquidity fragmentation is a major hurdle in the growth of decentralized finance (DeFi) ecosystems like Cosmos. Tokens are spread across multiple chains and DEXes, leading to poor swap performance, price discrepancies, and potential liquidity crises during severe market crashes. This fragmentation also results in capital inefficiencies, hindering the overall effectiveness of the ecosystem.

White Whale provides a comprehensive solution to the problem of fragmented liquidity through its interchain arbitrage infrastructure. By creating inter-blockchain connected Liquidity Pools representing interchain prices, implementing flash loan vaults, and deploying open-source arbitrage bots, White Whale facilitates seamless liquidity flow and decreases fragmentation.

You can read more about what White Whale is building in the article below:

Why is the project exciting now?

There are three main reasons why we feature this project in this week’s newsletter:

TVL vs Price

Airdrops

DeFi activities