TLDR: BTC is up but ETH is down. Bitcoin dominance is up. The hot coin we look at this week is AKT.

Latest & Greatest 📰

Before we dive into both current and new airdrops, make sure to check the latest and greatest news and market update from Coin Club:

Premium Newsletter Week 9 2024

Markets: BTC and ETH are up. Bitcoin dominance is up. The hot coin we look at this week is KUJI. Airdrops: Latest airdrops we started collecting are Blast Points, OUIX & EARN. New potential airdrops logged are Quick and Pac Points. News: Bitcoin Surpasses the $60K Mark After Two Years, Bitcoin EFT’s BTC AUM 4%, Blast’s Rocky Launch, Robinhood and Arbitrum Team Up, Dencun upgrade Live Date Announced, Stride Announces stDYM, Gemini Reaches Settlement with NYDFS & SBF Pleads for Shorter Sentence - Advises Prison Guards to Invest in Solana.

Bitcoin, Ethereum, Cosmos and more Week 9 2024

TLDR: Bitcoin Surpasses the $60K Mark After Two Years, Bitcoin EFT’s BTC AUM 4%, Blast’s Rocky Launch, Robinhood and Arbitrum Team Up, Dencun upgrade Live Date Announced, Stride Announces stDYM, Gemini Reaches Settlement with NYDFS & SBF Pleads for Shorter Sentence - Advises Prison Guards to Invest in Solana.

Make sure to follow Coin Club for continuous updates about all things Crypto, Blockchain and Web3.

BTC & ETH Market Update 📈

Crypto is looking up bigly this week, with BTC being up 10.8% and ETH up a whopping 14.1%:

Bitcoin dominance has been increasing over the week, starting at around 48.2%, topping at 51.3% and ending the week at 49.2%. Capital often starts to flow into ETH and other altcoins as the price is increasing for more risk-on assets as well, causing a lower Bitcoin dominance as we have started to see this week.

It’s going to be interesting to see whether this trend will continue in the short term, as capital in crypto tends to flow initially to BTC and then further out on the risk-curve, starting with altcoins like ETH and then into mid- or low-cap coins.

The Bitcoin halving is coming up end of March or beginning of April 2024. If history is any guidance we will continue to see BTC dominance climb up until after Bitcoin halving, whereafter people start to look for higher return moving further on the risk curve entering altcoins. This typically starts with ETH, and then on to mid- and low cap coins. Other coins being moved into are typically “ETH killers” like SOL, AVAX and other other L1s. Yet ETH is still the king amongst altcoins, as price action this week also shows.

With BTC dominance increasing and the ETH price decreasing while BTC price is increasing, the BTC/ETH ratio is trending upwards to 17.56 ETH per BTC, underlining that BTC continues to be king in crypto, but alts like ETH are gaining momentum.

For general news and updates on Bitcoin and Ethereum, make sure to subscribe to Coin Club’s free weekly newsletter.

Hot Coin: AKT 🔥

In this week’s newsletter we dive into Akash Network’s token with the ticker: $AKT.

The price action and volume is has been growing consistently, and doesn’t seem to stop any time soon:

What is the project about?

In a nutshell, Akash is a decentralized form of cloud computing, or in other words, a decentralized version of Amazon Web Services (AWS), Microsoft’s Azure, or Google Cloud. AWS, which by far has the largest market share of cloud services, currently supports many Fortune500 companies, from everything including McDonald’s to Ethereum node validators.

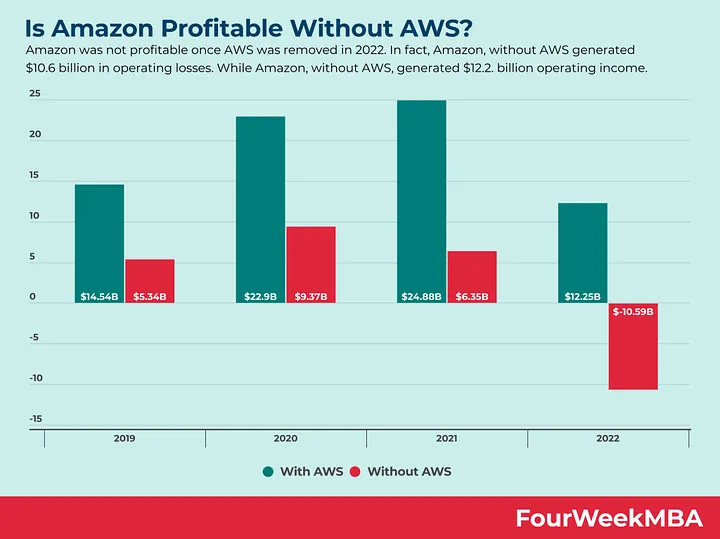

Just to give you an idea of how big the cloud computing market has become, if it wasn’t for AWS then Amazon would struggle to stay profitable post-COVID in 2022:

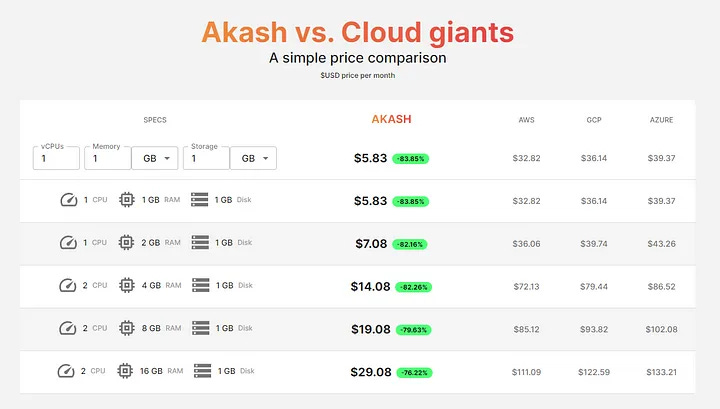

So cloud computing is a massive market with juicy margins that can be attacked by disrupters like Akash. Hence, the potential for new players is large to challenge incumbents with new promising tech such as blockchain. This is exactly what Akash is doing, and they are already getting ahead of these big players when it comes to price:

Essentially, Akash is becoming an unstoppable supercloud enabling users to buy and sell compute resources on a decentralized network, which could become a bigger industry than DeFi itself.

Why is the project exciting now?

There are three main reasons why we feature this project in this week’s newsletter:

Addressable market

Better resource utilisation

Better tech

Keep reading with a 7-day free trial

Subscribe to Coin Club to keep reading this post and get 7 days of free access to the full post archives.