Market Update Week 1 2024

The premium weekly crypto market update to grow your portfolio

TLDR: BTC is up but ETH is down. Bitcoin dominance is up. The hot coin we look at this week is AKT.

Latest & Greatest 📰

Before we dive into both current and new airdrops, make sure to check the latest and greatest news and market update from Coin Club:

BTC & ETH Market Update 📈

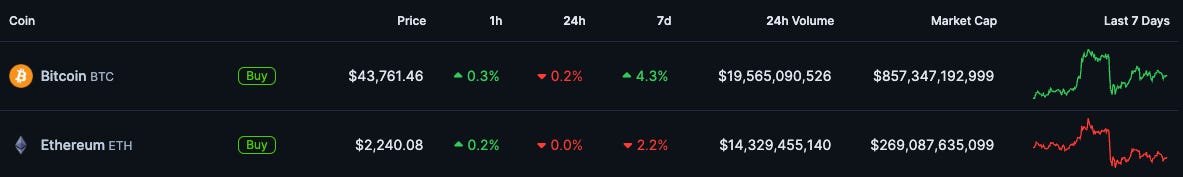

Contrary to last week, BTC is having a good week compared to the rest of the market, being up 4.3%, while ETH price is down 2.2%.

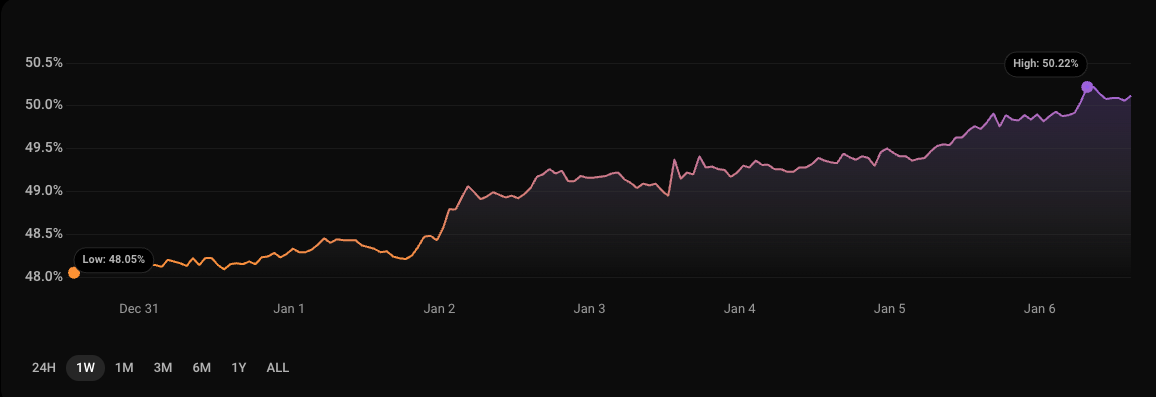

As a natural result of the BTC price increase, Bitcoin dominance has been increasing this week, peaking at 50.22%. It seems that capital still prefers to flow to Bitcoin up until the halving, where capital usually flows to up until when Bitcoin dominance has peaked and starts to decrease, moving capital into more risky mid- or low-cap coins.

The Bitcoin halving is coming up end of March or beginning of April 2024. If history is any guidance we will continue to see BTC dominance climb up until after Bitcoin halving, whereafter people start to look for higher return moving further on the risk curve entering altcoins. This typically starts with ETH, and then on to mid- and low cap coins. Other coins being moved into are typically “ETH killers” like SOL, AVAX and other other L1s. Yet ETH is still the king amongst altcoins, as price action this week also shows.

With BTC dominance increasing and the ETH price decreasing while BTC price is increasing, the BTC/ETH ratio is trending upwards to 19.55 ETH per BTC, underlining that BTC continues to be king in crypto, but alts like ETH are gaining momentum.

For general news and updates on Bitcoin and Ethereum, make sure to subscribe to Coin Club’s free weekly newsletter.

Hot Coin: AKT 🔥

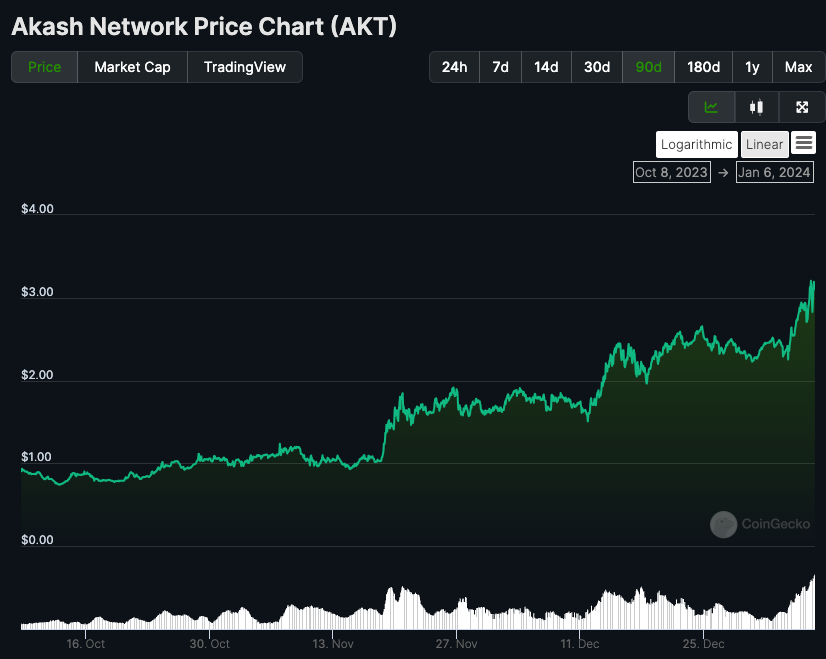

In this week’s newsletter we dive into Akash Network’s token with the ticker: $AKT.

The price action and volume is has been growing consistently, and doesn’t seem to stop any time soon:

What is the project about?

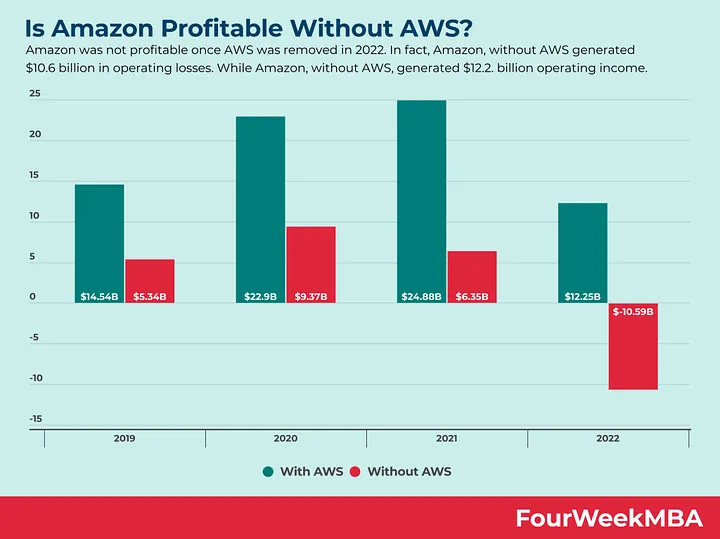

In a nutshell, Akash is a decentralized form of cloud computing, or in other words, a decentralized version of Amazon Web Services (AWS), Microsoft’s Azure, or Google Cloud. AWS, which by far has the largest market share of cloud services, currently supports many Fortune500 companies, from everything including McDonald’s to Ethereum node validators.

Just to give you an idea of how big the cloud computing market has become, if it wasn’t for AWS then Amazon would struggle to stay profitable post-COVID in 2022:

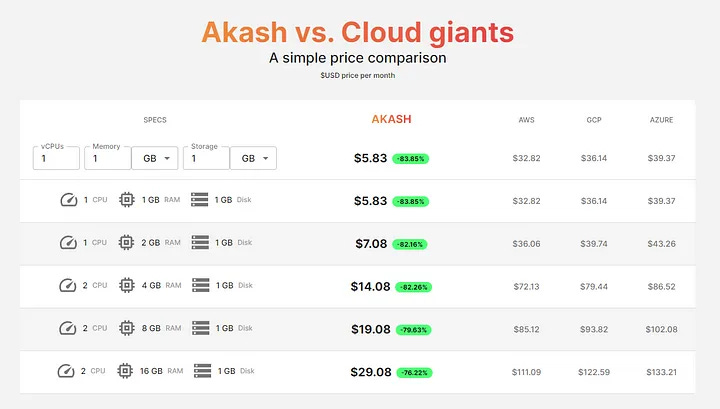

So cloud computing is a massive market with juicy margins that can be attacked by disrupters like Akash. Hence, the potential for new players is large to challenge incumbents with new promising tech such as blockchain. This is exactly what Akash is doing, and they are already getting ahead of these big players when it comes to price:

Essentially, Akash is becoming an unstoppable supercloud enabling users to buy and sell compute resources on a decentralized network, which could become a bigger industry than DeFi itself.

Why is the project exciting now?

There are three main reasons why we feature this project in this week’s newsletter:

Addressable market

Better resource utilisation

Better tech