Introducing Side Protocol: Interchain Atomic Swaps, Mesh Liquidity, Injective Integration and More

Exploring Side Protocol's Atomic Swaps, Mesh Liquidity and the Integration with Injective for Seamless Cross-Chain Asset Trading and DeFi Evolution

Side Protocol is the first modular and omnichain exchange layer offering a full stack, as well as dedicated infrastructure, tools, and applications for decentralized asset exchange.

With this, Side Protocol is enabling peer-to-peer trading across various Layer 1 chains without the need for traditional bridging mechanisms. IAS decentralizes liquidity across diverse blockchain networks, opening doors to a plethora of possibilities.

Side Protocol's mission is to become the pivotal exchange layer for Web3, enhancing asset exchange across diverse blockchain networks. Positioned at the forefront of the evolving DeFi landscape, it aims to boost accessibility and efficiency in decentralized asset exchange, fast-tracking the transition towards a more user-centric Web3 ecosystem.

Use Cases of Side Protocol

Side Protocol offers various use cases for their Interchain Atomic Swap (IAS) protocol, including

Automated Market Makers and Central Limit Order Book (CLOB)-based Orderbook

Over-The-Counter (OTC) Trading

Layer 1 functionalities, showcasing its comprehensive approach in addressing diverse needs within the asset exchange domain.

Let’s unpack the first two for further explanation:

Central Limit Order Book (CLOB) Trading: A Familiar Experience

Side Protocol's zk-rollup-based infrastructure for decentralized central limit order book trading is a game-changer for the DeFi landscape. This innovation offers traders a user experience reminiscent of centralized exchanges (CEX), making the transition from centralized to decentralized platforms seamless. The familiarity and enhanced trading experience provided by CLOB-based DEXs are essential for attracting and retaining users.

Over-The-Counter (OTC) Trading: Tailored for Customization

The Openside module within Side Protocol is instrumental in creating an omnichain OTC trading desk. This unique setup delivers an NFT marketplace-like trading experience, custom-tailored for OTC orders. OTC trading often involves large volume trades and customized orders, and Side Protocol's solution offers a secure and user-friendly platform to cater to these specific needs.

Atomic Swaps Explained

Atomic swaps are gaining popularity for their decentralized, secure, and private approach to exchanging digital assets across different blockchain networks. They eliminate the need for intermediaries and trusted third parties, ensuring that a trade is executed entirely or not at all, thereby preventing fraud and cheating. However, atomic swaps require compatibility between the participating blockchain networks, including cryptographic hash functions and transaction scripting languages.

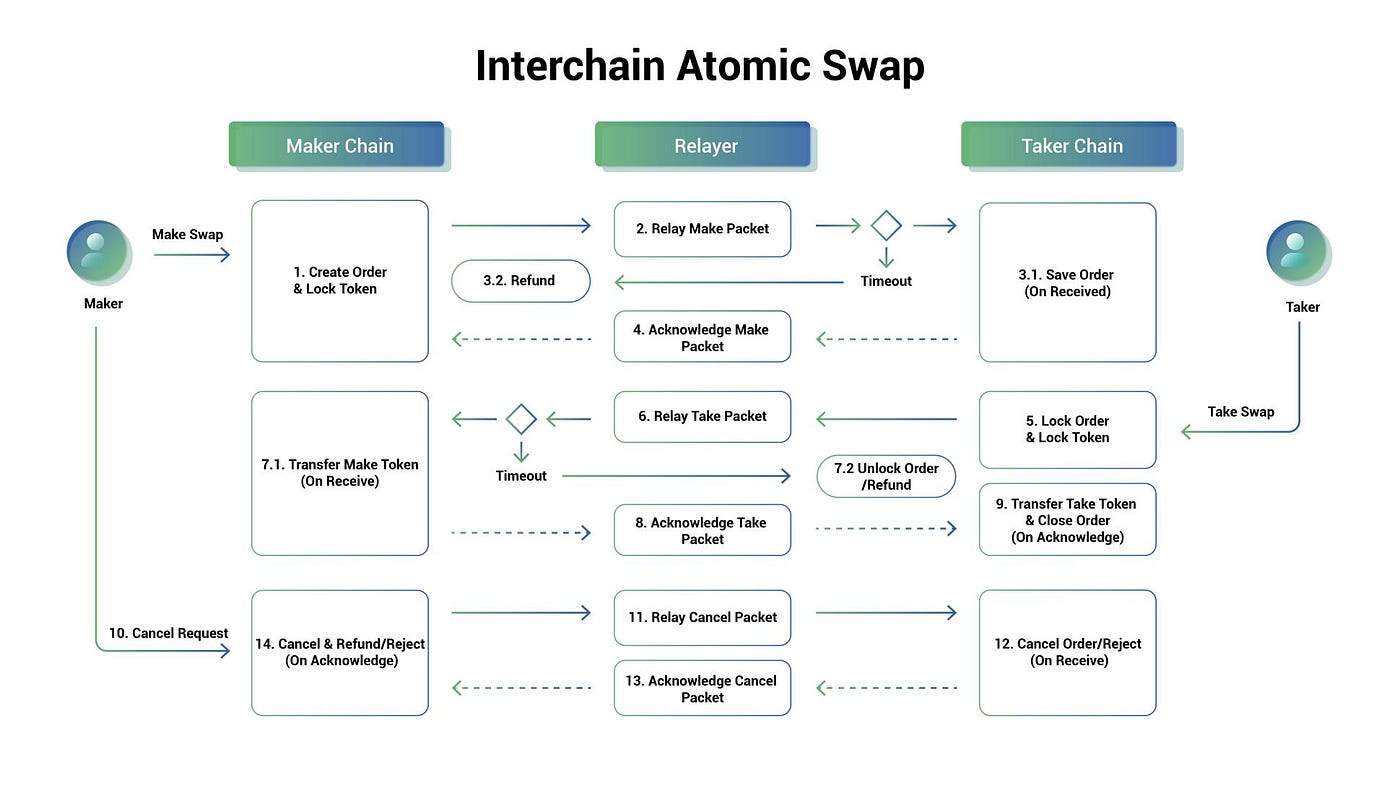

Interchain Atomic Swap (IAS)

Interchain Atomic Swap (IAS), developed by Side Labs and supported by the IBC Protocol core team, is an innovative IBC application focused on inter-chain asset swaps. It works by allowing makers to create orders, specifying the quantity and price of the exchange, and sending tokens to escrow accounts. Takers on different chains can then accept these orders and complete the exchange, all without the need for traditional IBC transfers. Unclaimed orders can be canceled, and a timeout window ensures the process's integrity.

Why Do We Need Interchain Atomic Swap?

IAS offers a bridgeless, scalable, and composable approach to cross-chain interoperability, eliminating the need for centralized intermediaries and bridges. This not only enhances user experience but also provides a robust security solution against malicious attacks.

The Role of IBC

The Inter-Blockchain Communication (IBC) protocol is at the heart of these developments, offering reliable, ordered, and authenticated communication between heterogeneous blockchains. Its modular design sets it apart from other cross-chain messaging protocols, making it versatile for various inter-chain applications.

The Mesh Liquidity Network

Side Protocol's Mesh Liquidity Network embodies a dynamic, decentralized, and interconnected liquidity distribution model, addressing liquidity fragmentation and enabling seamless asset transactions across different blockchains.

Mesh Liquidity's Role in DeFi

Mesh Liquidity aims to support various Arbitrary Messaging Protocols (AMPs) within different ecosystems, expanding its reach across major blockchain networks. This approach positions it as the modular liquidity layer for omnichain decentralized finance, creating a comprehensive footprint.

Side Protocol on Injective

As part of the Interchain Atomic Swap rollout, Side Protocol will deploy Cosmwasm-based inter-chain exchange smart contracts on Injective's testnet. These contracts leverage the IBC Protocol as the communication layer, enabling direct asset exchanges between the two blockchains. This integration promises faster, more secure, and cost-effective cross-chain transactions, setting a new standard for interchain DeFi.

Benefits for Injective

The integration of Side Protocol's technology with Injective's core stacks enhances the cross-chain DeFi experience. This integration brings about a new level of interoperability, allowing users to seamlessly exchange assets and explore a limitless world of decentralized finance. It introduces bridgeless peer-to-peer trading and automated market-making, setting the stage for a new DeFi era.

Thanks for reading Coin Club! Subscribe for free to receive new posts and support my work.

Injective, already a significant player in Web3 finance applications, benefits from Side Protocol's fresh liquidity avenues and the potential for DeFi innovations within its ecosystem. This partnership promises to elevate the capabilities of both platforms, enriching the DeFi experience for users.

App-chain Infrastructure: A Versatile Ecosystem

The SIDE Chain, designed as an app-chain infrastructure, is a versatile Layer 1 solution that caters to a wide range of applications. With the ability to deploy smart contracts without permission, it's poised to support a myriad of use cases. Whether it's for decentralized exchanges, NFT platforms, or other applications, the SIDE Chain's flexibility positions Side Protocol as a vital player in the DeFi landscape.

In conclusion, Side Protocol's partnership with Injective and its focus on Interchain Atomic Swaps is a testament to the ever-evolving and innovative nature of the DeFi space. This collaboration promises to reshape cross-chain asset exchange and decentralized finance, ultimately benefiting users and driving innovation in the crypto space.