Gnosis Chain: The Unlikely DeFi Success Story Amid Crypto Winter

Understanding the Factors Behind Gnosis Chain's 80% Surge

In the midst of a challenging period for DeFi protocols, Gnosis Chain, an Ethereum sidechain network, has managed to stand out as a beacon for investors.

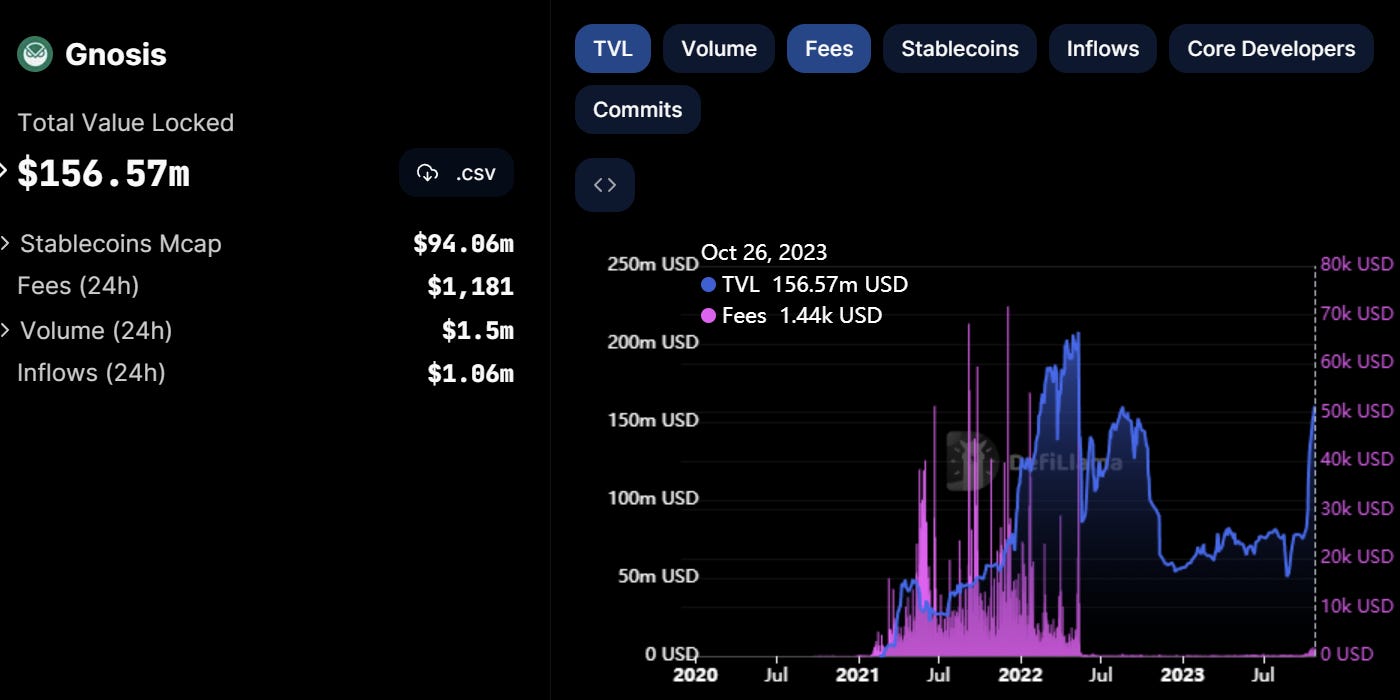

Over the past 30 days, Gnosis Chain's Total Value Locked (TVL) has witnessed a remarkable 80% surge, reaching $140 million, as per data from DefiLlama. This achievement is notable in a bear market where other major DeFi-enabled blockchains like Ethereum have experienced a 12% decrease in TVL. But what sets Gnosis Chain apart, and why has it been able to attract investors despite the crypto winter?

The Gnosis Chain Advantage

A confluence of several factors has contributed to Gnosis Chain's unexpected success, according to its founder, Martin Köppelmann. Two key elements are at play here.

First, the anticipated rollout of Gnosis Pay has drawn the attention of projects like Maker's Spark and Aave. Aave, a top DeFi lending protocol, is now making its presence felt on Gnosis, and Spark, a retail lending protocol offered by MakerDAO, has also joined the fray.

Second, the introduction of sDAI, which allows users to swiftly boost their DAI Savings Rate, attracted around $50 million in new capital.

This development marked the beginning of Gnosis Chain's support for sDAI, an interest-bearing version of DAI, MakerDAO's widely-held US dollar-pegged stablecoin.

This liquid DAI token represents the equivalent amount of the stablecoin staked in the DAI Savings Rate on the Spark Protocol. Gnosis Chain's bridge has now become the third-largest holder of sDAI, signaling substantial investor activity around this yield token.

Contributions from the Bridging Frenzy

The bridging frenzy has not only benefited Gnosis Chain but also had a positive impact on the crypto bridge Hop Protocol, which experienced the highest TVL growth on Gnosis over the last month.

Chris Whinfrey, the founder of Hop Protocol, noted that they onboarded around $1 million to Gnosis in the past month, with the majority likely coming from the mainnet via the native bridge.

The surge triggered by sDAI deployment on Gnosis appears poised to attract more investment.

Diversification and Tokenization

Martin Köppelmann mentioned that sDAI is rapidly being integrated into the Gnosis DeFi system through various protocols like Agave, Balancer, and Curve.

Holding sDAI allows users to earn a 5% annualized yield from MakerDAO's revenue, which can be further increased by deploying liquid sDAI into platforms like Agave, a Gnosis-native lending market that has attracted over $10 million in investments.

Moreover, asset tokenization is emerging as a significant market segment within Gnosis.

RealT, a real estate tokenization platform, has garnered $98 million in investments, though this figure does not reflect in Gnosis TVL numbers due to the exclusion of data from subprotocols by DefiLlama.

Gnosis is also home to a growing tokenized equities market, further demonstrating the platform's expanding appeal to investors.

Conclusion

While Gnosis Chain has certainly made significant strides, it still lags behind other DeFi majors like Arbitrum, BNB Chain, and Polygon in terms of TVL.

Nonetheless, its 80% surge in investments during a crypto winter is a testament to the unique factors and growing ecosystem that have allowed Gnosis Chain to defy the odds.

As it continues to expand its offerings and attract new projects, Gnosis Chain's place in the DeFi landscape is one to watch.