Curve Finance issuing their own stablecoin crvUSD

crvUSD is taking the world by storm, making it possible to mint stablecoins with BTC, ETH and liquid staked versions of ETH like sfrxETH and wstETH

Curve and $crvUSD is killing it!

$crvUSD is taking the world by storm, making it possible to mint stablecoins with $BTC, $ETH and liquid staked versions of $ETH like $sfrxETH and $wstETH. Let's look closer at the stablecoin issued by @CurveFinance.

Before we dive into the inner workings of $crvUSD, let's do a reality check.

Has the price of $crvUSD stayed at peg?

Answer: Yes.

Is borrowing and lending following a nice positive trajectory?

Answer: Yes.

$crvUSD maintains its peg via its dynamic interest rate and Peg Keepers (which is similar to @fraxfinance's AMO).

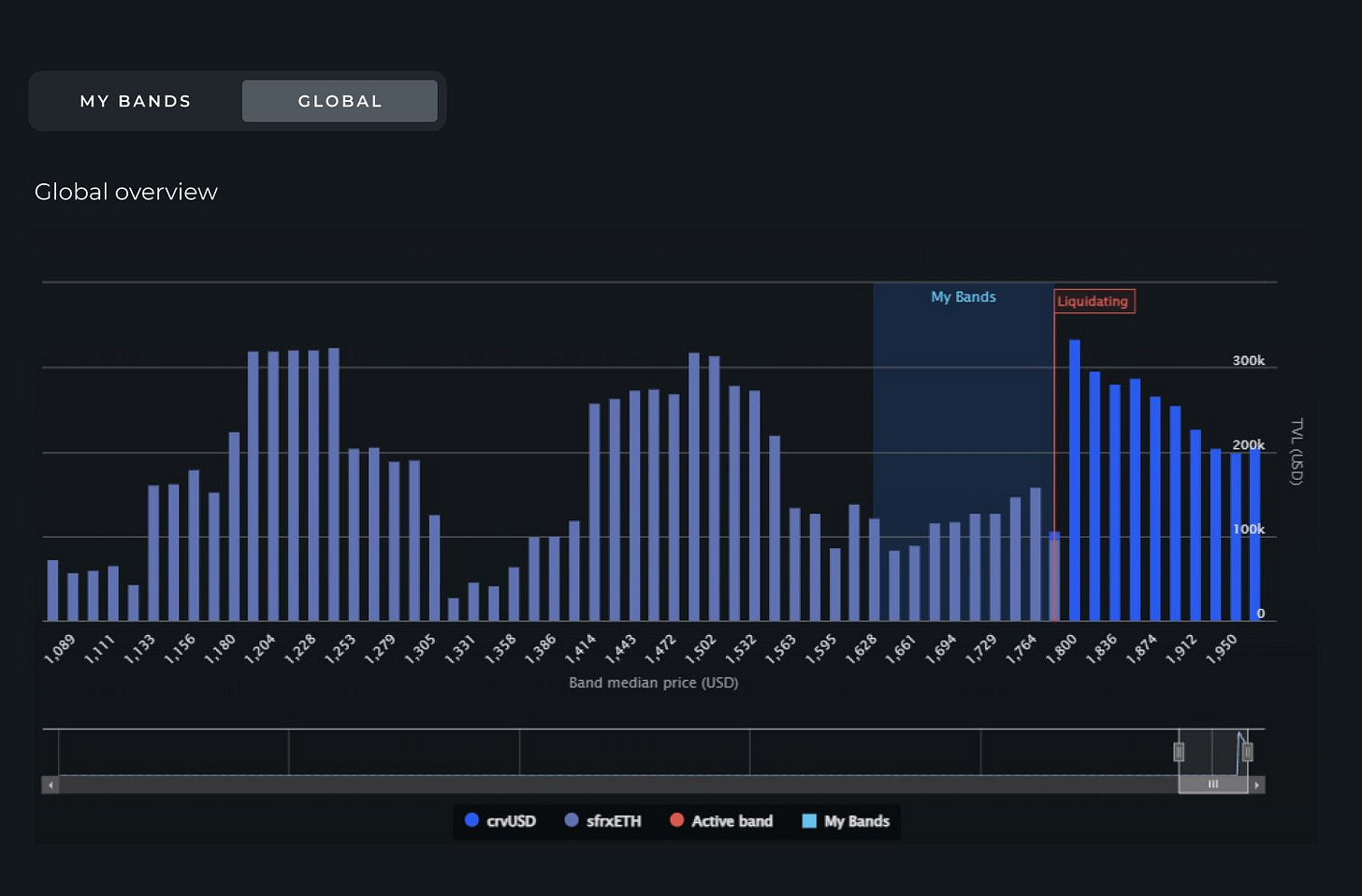

The peg is maintained by minting or burning $crvUSD in its liquidating AMM algorithm aka LLAMMA - Lending Liquidating AMM Algorithm.

LLAMMA is a new type of AMM that incentivizes arb bots to liquidate the collateral in the active band by in-/decreasing the P_AMM price (price of collateral in the pool) *faster* than the P_ORACLE (market price).

Let's look at two cases:

P_AMM < P_ORACLE

P_AMM > P_ORACLE

Case 1: If oracle price decrease (P_AMM < P_ORACLE)

If oracle price starts to fall, the algorithm will make the AMM price *fall faster*, creating an arbitrage opportunity to deposit crvUSD into pool and withdraw ETH. This results in collateral being liquidated to crvUSD.

Case 2: If oracle price increase (P_AMM > P_ORACLE)

If oracle price starts to rise, the algorithm will make the AMM price *rise faster*, creating an arbitrage opportunity to deposit ETH into pool and withdraw crvUSD. This results in collateral being shifted back to ETH.

Importantly, there is no debt repayment during the process of soft liquidation.

It's just rebalancing the collateral by shifting it from a volatile asset (eg ETH) to stablecoin (crvUSD), and vice versa.

The more non-volatile collateral, the 'healthier' the position.

Soft vs hard liquidation

When compared to hard liquidation losses in other lending protocols (penalties around ~7%), the data so far shows that losses during soft liquidations are significantly lower.

How much lower?

Around 1-2%, and getting lower by the day almost!

During soft liquidations, you are essentially selling collateral at a slightly lower price than the market price (to arb bots), and buying at a slightly higher price (from arb bots) during deliquidation. So if there are big price swings, losses increase.

This is possible through the bands defined, meaning also that collateral can't be adjusted during or after soft liq. The only actions possible after the soft liq. process are:

Self-liquidate: closing the position.

Payback: since the collateral in bands is left unchanged.

Supplying, withdrawing, and borrowing is available only before soft liquidation.

In other words, when soft liquidations start to happen, you are limited to only being able to self-liquidate or payback.

But hey.

Better than getting totally rekted in a hard liquidation!