BlackRock's Intensive Negotiations for Bitcoin ETF Approval

Persistent Dialogue with the SEC and BlackRock to trailblaze the spot BTC ETF space

Throughout the bustling holiday season, BlackRock, the world-renowned asset management firm, has been engaging in extensive discussions with the U.S. Securities and Exchange Commission (SEC) to introduce a spot bitcoin Exchange-Traded Fund (ETF).

This move places BlackRock among the numerous fund groups eagerly awaiting the green light to launch such financial instruments. Bloomberg Intelligence analyst James Seyffart provided data highlighting that these applicants have collectively held 24 meetings with the SEC.

BlackRock's Strategic Moves for ETF Inclusion

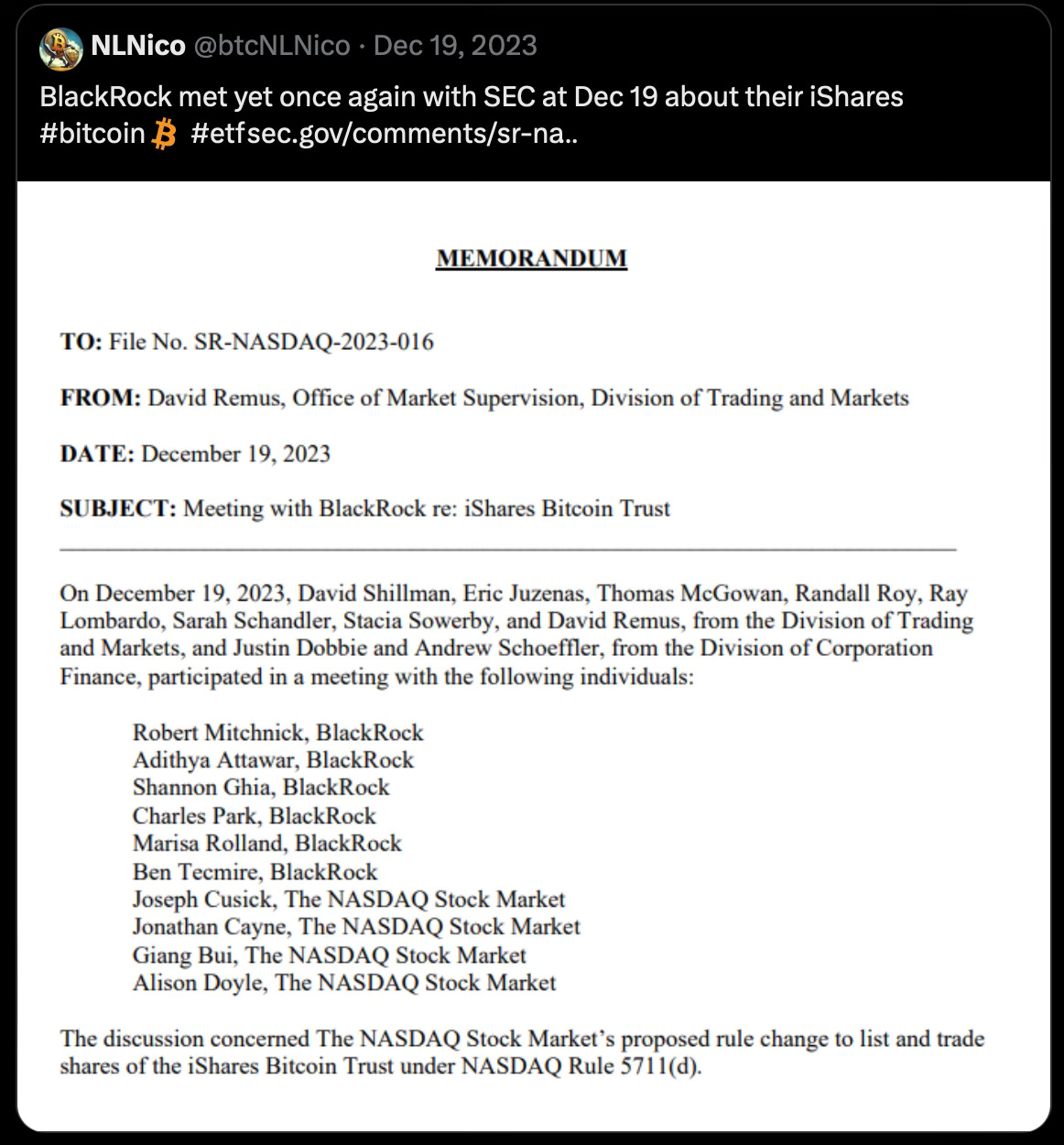

On the 19th of December, a strategic convergence took place between representatives from BlackRock, the SEC, and Nasdaq. The primary subject on the table was BlackRock’s ambition to launch its spot bitcoin ETF, known as the iShares Bitcoin Trust. This endeavor aims to see the trust's shares listed on Nasdaq, trading under the ticker IBIT.

In preparation for the meeting, BlackRock submitted significant revisions to its S-1 filing for the proposed ETF. CryptoSlate disclosed that the up-to-date amendment encompassed six key changes, signaling a more refined approach compared to the previous filing, which saw a hefty 21 modifications.

A Question of Creation and Redemption Models

The creation and redemption models are crucial to understanding the operations of the upcoming bitcoin ETFs. Through SEC discussions with fund issuers, these models have been meticulously scrutinized and are detailed in released memoranda. Here's what's emerged:

In-Kind Transactions: This traditional method means exchanging ETF shares for securities that reflect the ETF's holdings.

Cash Creations and Redemptions: The alternative involves creating and redeeming shares directly with cash.

BlackRock has sculpted its proposal to initially favor cash transactions, as outlined in its S-1 document. This approach seems to align with the SEC's preference, judging by amendments to other proposals. However, the SEC has remained silent on the matter, offering no public commentary.

In maintaining a flexible stance, BlackRock has not dismissed the idea of in-kind transactions. The firm indicates that, should Nasdaq secure the required regulatory approvals, it may adopt in-kind transactions for bitcoin in the future. Thus, BlackRock's strategy is adaptable, poised to shift as the regulatory landscape evolves.

SEC's Stance on Transaction Models

Eric Balchunas, an analyst from Bloomberg Intelligence, suggested in a November post that the SEC is advising bitcoin ETF aspirants towards adopting cash creation models. He elaborated that this orientation would lead to scenarios where only ETF issuers handle the digital asset directly, leaving intermediaries out of direct bitcoin transactions.

High Stakes and Expectations

The series of consultations between BlackRock and the SEC have become more frequent, with three meetings taking place over seven business days. However, since November, five engagements in total have been reported. The focus is firmly fixed on BlackRock, which boasts an impressive track record with the SEC, overseeing approximately $2.5 trillion in U.S. ETFs and historically facing only one proposal rejection.

As the industry watches, the possibility of BlackRock's first spot bitcoin ETF approval looms, a decision that could set precedents for others like Ark Invest, who have previously faced denial. Analysts from Bloomberg Intelligence predict that the SEC's ruling could emerge between January 5 and January 10, the latter of which is the deadline for ruling on a joint proposal by Ark Invest and 21Shares.

Speculation is rife that the SEC may use the occasion to announce its stance on multiple bitcoin ETF applications on or by the January 10 cutoff. With such deliberations and the potential impact on the crypto financial landscape, all market participants and observers are awaiting the authoritative verdict with bated breath.